Understanding the information that prospective buyers look for at each stage of the buying cycle can help firms correctly structure their content creation strategies. SMEs can now plan the content required that will help them win margin rich orders from large enterprises.

Respected publisher IDG undertook some analysis of the way IT decision makers in large enterprises used the web when they wanted to buy new products and services. That analysis offers some really valuable insights into the way large enterprises buy in general. It means you can now organise your sales and marketing content in a way that will attract and engage these buyers and influencers.

By following a few simple guidelines, you can significantly improve your chances of making sales to firms with larger than average cheque books!

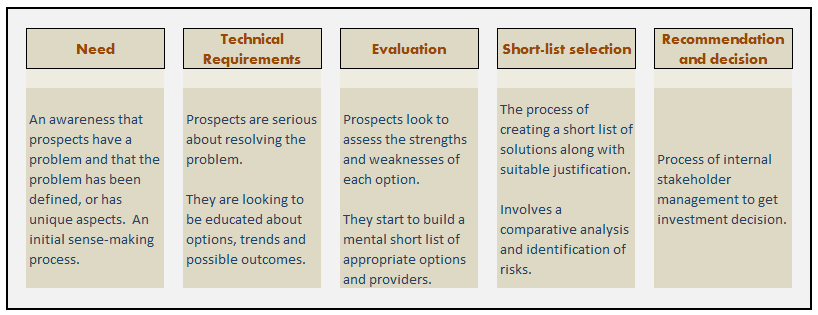

The IDG analysis tracked the information decision makers looked for at each stage of the buying cycle. The cycle as such is usually depicted as a five step sequential process. It starts with identification of the problem, moves on to evaluation and selection, until a purchase decision is reached. Typically, the process looks like this:

IDG tracked 1025 decision makers to identify what materials they looked for in each buying stage. The findings suggest that some content can be used across a number of different stages. This means you don’t need to create lots of articles, whitepapers and case studies to address each individual stage, at least not to begin with. Instead, just ensure that the content you do create serves the information needs of your web visitors at each stage of the buying cycle. Here’s a summary of what prospects are looking for based upon the IDG analysis:

Need:

- Articles and whitepapers on trends, strategies and different technologies

- Case studies and blogs of real examples.

Your prospects are looking to relate their own situation to one that might have been experienced by someone else. By comparing symptoms, your prospect goes through a sense-making exercise – trying to determine if his/her problem is a common one, whether there is an easy solution or if their situation is something more complex and unique. At the end of this stage, prospects will have defined the nature of the business problem/need.

Technical requirements:

Having rationalised the problem/need, if your prospect is serious about resolving the problem, their attention will turn to understanding the different options available for a fix. They will be looking for:

- “How to…” content

- Relevant whitepapers, articles and blogs

- Case studies and interviews with firms that have had similar problems.

Prospects will be looking to develop a deeper understanding of the problem, options and related consequences. In this stage, they will begin formulating a short list of the different solutions that seem worth exploring in more detail.

Evaluation:

Each option identified will be quickly assessed for suitability. Those felt to be most appropriate to your prospect’s specific circumstances will be investigated further. They will search for:

- Product tests and reviews as well as industry news coverage

- Product demonstrations and literature

- “How to” content, whitepapers, articles, case studies and blogs

- Expert assessments

- Buyers guides and peer comment

Prospects will mentally start drawing-up a short list of preferred solutions. The experience in gathering and reading through literature will influence which vendors are likely to be shortlisted for the next stage.

Short-list selection:

At this point in the process, decision makers are starting to take a more formal approach to information capture. Buyers look for:

- Product tests and reviews

- Product descriptions and technical details

- Expert research, reviews and interviews

- Supporting independent technical and industry commentary

- Buyers guides

Prospects are now building an objective comparison of options and identification of risks. Price and other associated costs will come into play as preliminary business cases are formulated.

Recommend and decide:

Prospects are now looking to finalise a robust business case that suits their needs. Bias may have already been introduced based on the experiences with candidate vendor web sites and downloadable materials. They will be looking for:

- ROI tools

- Supporting case studies and testimonials

- Expert commentary

- Up to date product descriptions, roadmaps and technical information

- Most recent product tests and reviews

- Articles and whitepapers about future trends

Prospects at this stage are looking to justify the investment they want to make to internal stakeholders. Given that personal reputations can be affected if large investments go wrong, prospects are looking to include content that is highly trustworthy and reliable, or offers a low risk exit option.

What comes out of this analysis is the need for you to create high quality, relevant content that meets the needs of buyers at each stage of the purchase process. You can directly influence the creation of articles, whitepapers, case studies, blogs, ROI tools and product literature. Just be sure that each item addresses the needs of prospective buyers wherever they are in the buying process. Your ability to influence review writers and experts is a much harder task, and often requires a large dose of luck!

Given this knowledge, you should be able to review your sales and marketing literature and make plans to re-align existing content to each stage of the buying cycle. You need to identify any gaps in your library and get them filled with suitable content. Make this a priority for your marketing team or outsource the task to a professional copywriter.

The trick then is to test and keep the content up to date. Testing is important as you’ll want to ensure that each item of content created is as effective as it can be in winning new business. Simple A/B testing over time will help you to ensure this is the case.

Keeping content refreshed is important too. You need to continually look at what competitors are producing and ensure your content minimises weaknesses whilst playing to your strengths. Good copywriting will again be a key ingredient in bringing you success.

::::::::::::::::::::::::

Freelance copywriting and ghost blog writing tailored to SMEs

Pingback: How B2B Product Managers can create and implement a successful content marketing strategy | Komment on...